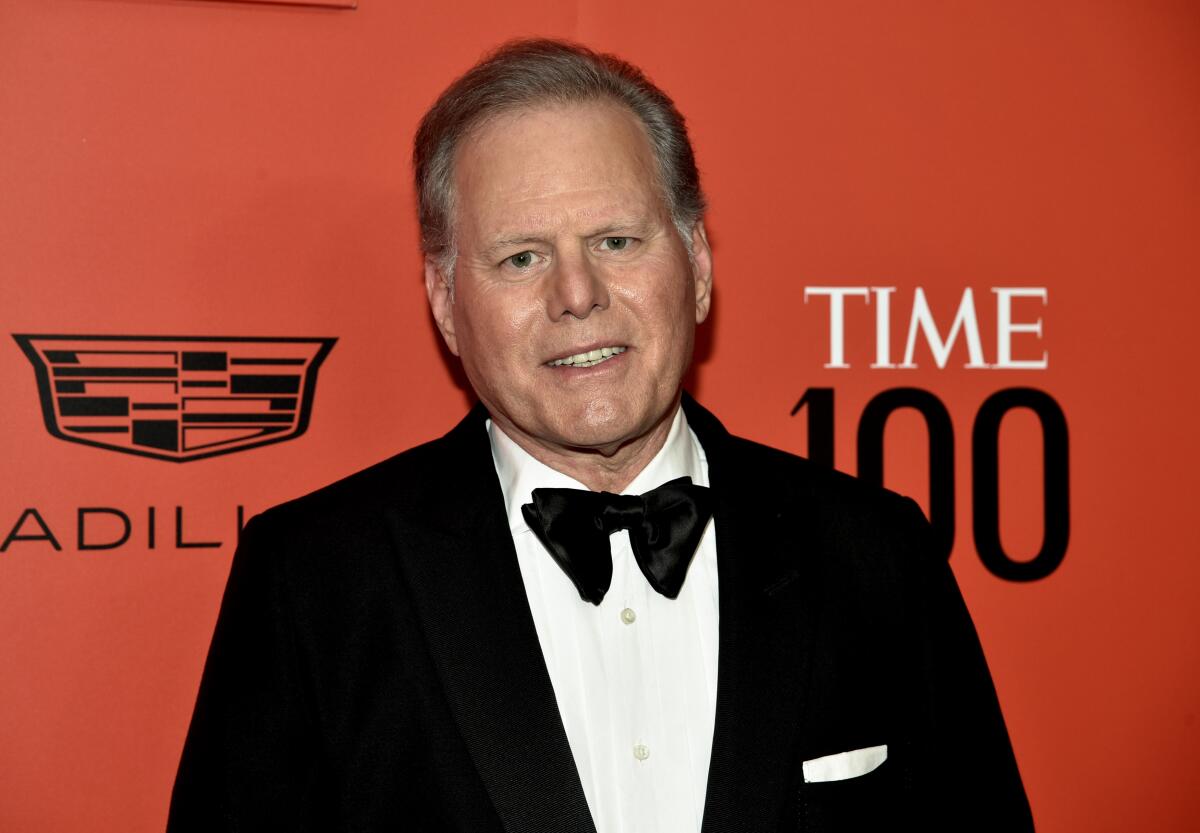

Warner Bros. Discovery’s Zaslav takes conciliatory tone on striking actors and writers

Warner Bros. Discovery Chief Executive David Zaslav expressed hope Thursday for a resolution in the strikes by the writers and actors that have brought TV and film production to a standstill.

“I think all of us in in this business are very keen to figure out a solution as quickly as possible,” Zaslav told analysts on the company’s second-quarter earnings call.

Perhaps aware that wealthy media moguls — including himself — have been ridiculed at strike rallies by the Writers Guild of America and SAG-AFTRA for being greedy, Zaslav took a conciliatory tone when addressing the labor standoff.

“We’re hopeful that all sides will get back to the negotiating room soon, that these strikes get resolved in a way that the writers and actors feel they are fairly compensated and their efforts and contributions are fully valued,” Zaslav said.

Zaslav has been mocked by the guilds for his comment in May that “love for the business and a love for working” would eventually lead to an end of the writers strike.

His remarks come a day before the Writers Guild’s negotiating committee and the Alliance of Motion Picture and Television Producers, which bargains on behalf of the studios and streamers, meet to discuss negotiations. The two sides have not convened since the writers’ strike commenced on May 2.

The striking actors’ fight for improved residual payments and AI protections received the support of the New York City Council’s committee on civil service and labor.

SAG-AFTRA began its strike on July 14. Both guilds are looking for improved residual payments for streaming and protections against the use of artificial intelligence.

While WBD executives did not mention any timetable for a resolution, their financial models for the year are based on a return to work by September.

The stoppage of the production of scripted content at the company led to a savings in the “low $100-million range” in the second quarter, Warner Bros. Discovery said.

Executives did not play up the strike-related savings, however, as any benefit from the work stoppage will be short-lived.

WBD is battling Netflix, Comcast and other media companies for audiences in the streaming market, and a pipeline of fresh programming is key to making its Max a must-have service.

“We are in some uncharted waters in terms of the world as it is today and measuring it all,” said Zaslav.

Overall, Warner Bros. Discovery posted a net loss of $1.2 billion, or 51 cents a share, down from the $3.4 billion, or $1.50 a share, it lost in the same period a year ago. The company missed Wall Street estimates but reported improved free cash flow of $1.7 billion compared to $789 million a year ago.

Steven Spielberg, Paul Thomas Anderson and Martin Scorsese will be involved in curating the classic film channel which will now operate under the company’s top film studio execs.

Weaker-than-expected theatrical box office results from “The Flash” and a soft advertising market were mitigated by ongoing cost reductions throughout the company.

Over the past year, WBD has undertaken thousands of layoffs across divisions such as CNN and other cable networks and slashed dozens of TV programs and movies as it tries to reduce debt.

Revenue rose 5% to $10.4 billion. The potent box office results from the global success of “Barbie,” released earlier this month, were not included in the results.

The company saw an expected drop in subscribers resulting from the relaunch of its direct-to-consumer streaming service HBO Max on May 23.

SAG-AFTRA has approved a deal from the studios to end its historic strike. The actors were on strike for more than 100 days.

Now called Max, the new service combines the content of HBO Max and Discovery+, which led to an overlap of 4 million customers. The company reported 95.8 million subscribers, down 1.8 million from the first quarter.

“The migration to Max has gone exceedingly well, with the overwhelming majority of subscribers in the U.S. successfully transferred,”

Zaslav said.

Zaslav said the company is seeing consumers spend more time with Max since the changeover.

The loss in streaming revenue from the changeover was far less than anticipated. The streaming unit posted a loss of $3 million, after posting a profit of $50 million in the first quarter. But that is far better than the $518 million loss posted a year ago.

WBD’s stock price was down around 1% at $12.40 a share in midday trading.