Meet the TV guy who just guided Universal Pictures to its best year yet

- Share via

A sleek black screen fills an entire wall of Universal Pictures’ executive conference room. The enormous display, measuring 24 feet by 5 feet, resembles a futuristic version of the game board for the TV show “Jeopardy.”

It is a high-resolution, eight-dimensional digital calendar marking release dates of upcoming movies. Dec. 18 has been reserved for “Star Wars: The Force Awakens” from Walt Disney Co. March 25 was claimed by Warner Bros. for its clash of superheroes, “Batman v Superman.” Universal has staked out July 29 for its next Jason Bourne spy thriller with Matt Damon.

“It was Velcro when I got here — just names of movies placed on the wall with Velcro,” Jeff Shell, chairman of Universal Filmed Entertainment Group.

SIGN UP for the free Indie Focus movies newsletter >>

He became Universal Pictures’ top executive two years ago with a mandate to ease the 103-year-old film studio into the digital age. His elevation came amid seismic shifts in the entertainment industry. Theater attendance in the United States has declined, DVD sales have been in a prolonged slump, and streaming services such as Netflix are elbowing into turf long reserved for movie theater chains. All the while, high-quality TV programs now rival studio films for cultural relevance — giving consumers plenty of easy entertainment options.

When the veteran TV executive was named head of the film studio in September 2013, Hollywood’s entrenched power crowd was surprised, even incredulous, that NBCUniversal and its parent, Comcast Corp., would hand the keys to its most prestigious property to someone with no experience in the film business.

And movies are the Rolls-Royce of content. We need to figure out how our movie content fits into this fragmenting, changing world.

— Jeff Shell

But Comcast wanted a corporate insider who was a Hollywood outsider to lead its charge.

“Movies are right at the center of what Comcast is trying to do,” Shell said.

The 50-year-old executive, who has spent nearly half his life in the television business, is feeling more comfortable as a studio boss. On a recent afternoon, he proudly showed off his library-style wooden desk once used by Universal’s legendary mogul Lew Wasserman. Shell had it hauled out of storage.

It also helps that Universal Pictures is closing the books on its most profitable year ever. The Los Angeles studio is on track to deliver more than $1.25 billion in profit this year, up from $711 million in 2014.

Universal has been No. 1 at the box office for most of the year and has generated $5.8 billion in film revenue during the first nine months of 2015 — a 52% increase over the same period last year.

Three of its films — “Furious 7,” “Jurassic World” and the animated “Minions” — each have topped $1 billion in global box-office receipts — a feat no other Hollywood studio has achieved.

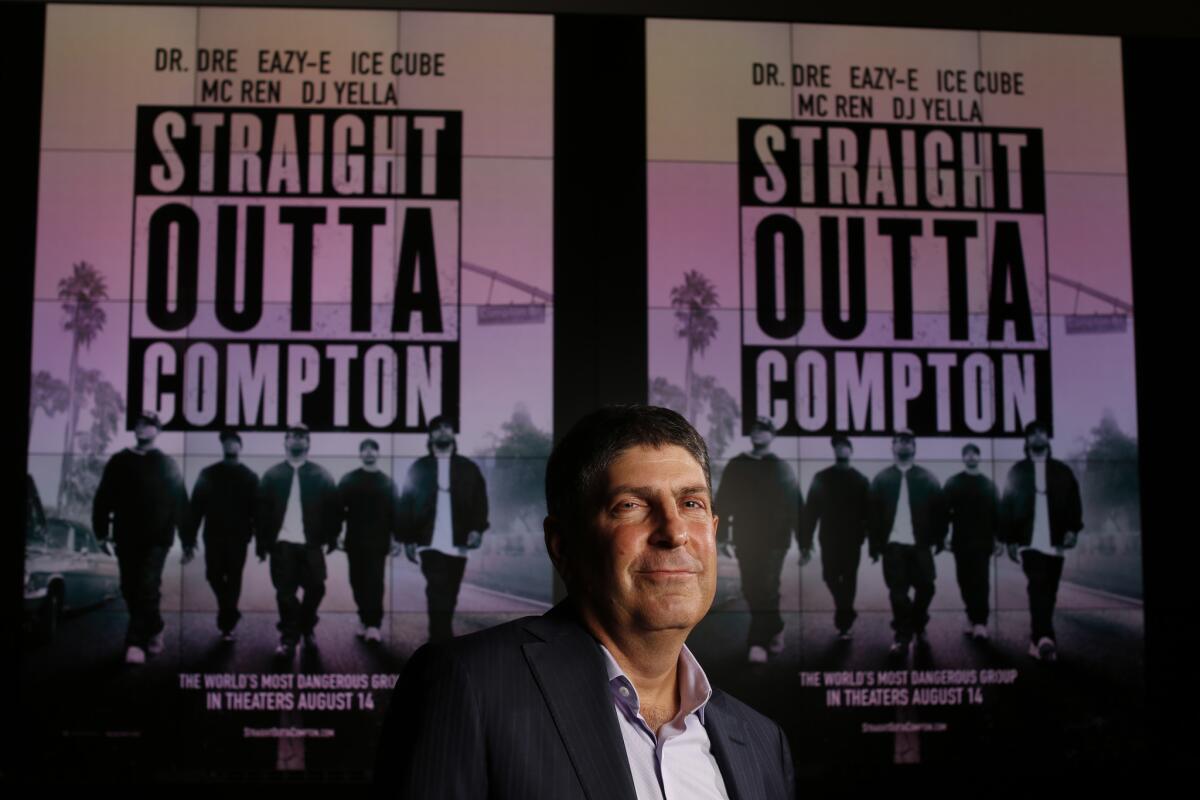

Jeff Shell is photographed in front of posters for Universal Pictures’ hit musical biopic “Straight Outta Compton.”

“In the movie business you need great product, great executives … and then it’s luck and timing,” said Ron Meyer, the president of Universal Studios for 18 years before he segued into the role of vice chairman of NBCUniversal to help Shell manage the studio. “You need all these things to come together.”

Shell, in a departure from the Hollywood norm, said he didn’t want to hog credit for the studio’s banner year.

He heaps praise on Donna Langley, the chairman of Universal Pictures, who picks the movies and oversees production and marketing, as well as Meyer and other senior executives. Universal is one of Hollywood’s most prolific studios — producing about 40 movies a year.

Next year probably won’t be as profitable as this one, Shell acknowledged, largely because Universal won’t be releasing as many tentpoles. There are also challenges brought on by changes in consumer behavior. Technology has roiled the economics of music, publishing, video games, and now TV and film.

“My career has been spent being parachuted into new businesses, and trying to figure out what I need to do with those businesses,” Shell said. “I am good at building things. I want to be in a business that needs fixing or is transitioning.”

The Los Angeles native is the oldest of four high-achievers born to a Cedars-Sinai cardiologist and teacher turned stay-at-home mother. (Shell’s sister is the U.S. ambassador to Qatar). A sports fanatic, Shell — who is 5 foot 9 — made the varsity basketball team at University High after spending long hours in his backyard perfecting his jump shot.

“He wasn’t the dorkiest, but he wasn’t the coolest kid by any means,” said his younger brother, Dan Shell, an executive at Fox Sports. “There was this grassy hill at our high school that was called ‘the Grove,’ and the cool kids would hang out together at the top of the hill. Jeff was in the group that got to hang out at the base of the hill. He was a ‘base of the Grove’ kind of guy.”

Shell earned a degree in economics and applied mathematics from UC Berkeley, and an MBA from Harvard University.

He started his career at the Salomon Bros. investment bank before joining Walt Disney Co. in strategic planning. He worked a variety of jobs for 11 years at Rupert Murdoch’s News Corp., including a year as chief executive of the troubled Gemstar-TV Guide International, which Fox then co-owned.

In 2004, Shell gambled on Comcast. He moved with his wife, Laura, and their daughter across the country to go to work for the Philadelphia cable Goliath with giant ambitions.

He was in charge of Comcast’s cable channels, including E!, the Golf Channel and its regional sports networks.

Comcast’s acquisition of NBCUniversal from General Electric in 2011 left industry observers guessing that Shell was in the pole position to control a big chunk of the NBC television empire.

But Shell ended up the odd man out. NBCUniversal CEO Steve Burke sent him to London to learn the international television business.

“I don’t think it was his first choice, and it was not a logical choice,” Burke said. “But I figured it would give him unique experience across the company, and it would make him a better executive.”

By 2013, the corporate brass was frustrated with the management and uneven performance of Universal Pictures, which also seemed caught up in the vanities of Hollywood that Burke disdains. Burke promoted his longtime lieutenant and shrugged off Hollywood’s reaction.

“I was fully aware that he had never made a movie, or marketed a movie,” Burke said. “But Jeff is a very able executive. And the bigger the job in these companies, the more important it becomes that you can work well with the team. And Jeff has a particular style, and a humility about him.”

Shell quickly went to work. He revamped Universal’s consumer products division and opened a sizable outpost in China. Foreign territories now make up about 70% of a film’s overall ticket sales.

Until last year, Universal had just one person in China, the world’s second-largest movie market. Now there are 18.Sending Shell to Hollywood also telegraphed a clear message. Comcast wanted to draw Universal tighter into the fold after allowing it to operate as a detached satellite with different sensibilities.

“Before I got here, Universal never really joined the fight,” Shell said. “We needed to be part of the company, and we are now.”

Comcast long had ambitions to own content as a bulwark to its business in these fast-changing times. That’s why it bought NBCUniversal.

Comcast recognized there was a symbiotic relationship between high-quality movies and TV shows and the company’s cable lines that connect to more than 22 million homes.

The best way to retain cable customers is by providing good content.

“And movies are the Rolls-Royce of content,” Shell said. “We need to figure out how our movie content fits into this fragmenting, changing world.”

Jeffrey Cole, director of the Center for the Digital Future at USC Annenberg School for Communication and Journalism, said rough seas are ahead.

“The movie business is changing. ... It is close to another tipping point,” said Cole. “I’m not sure that getting people out to the theaters is what it used to be.”

Theater attendance has declined, but higher ticket prices have enabled the industry to maintain its profits. This year is expected to be the first in which the domestic box office tops $11 billion.

But streaming services and downloads of movies from Apple iTunes, Amazon Video and other services have become a fast-growing segment.

During the first nine months of the year, consumers spent $1.37 billion downloading movies and TV shows, a nearly 20% increase over the same period last year, according to DEG: the Digital Entertainment Group.

“Someone can watch hundreds of original programs on Netflix and on TV,” Shell said. “And we are in the business of asking people to get in their cars to go somewhere to watch a movie — not just turn on the TV.”

Movie studios would like to push their film product into homes faster, but they have run into considerable resistance from theater owners who have fought for more than a decade to protect their period of exclusivity, which is typically 90 days, before a film is released to home video.

Comcast has much to gain if moviegoers stay at home to watch feature films on their big TV screens. The company has made movie downloads an easy option for its cable customers. It promotes its deep trove of on-demand films and TV shows to entertain subscribers.

Consider that Comcast now ranks as the second-biggest digital vendor of Universal movies, behind Apple’s iTunes store, even though its service is not available nationwide.

The rising cost of theater tickets is making at-home movie downloads more attractive, USC’s Cole said, adding that research has shown a willingness by families to spend about $50 to download a just-released movie to watch at home.

But experiments with tandem releases into theaters and home video have not been successful, and movie theater chains often have banned those movies from their screens.

“The theater experience is not going away,” said Paul Dergarabedian, senior media analyst at Rentrak. “People still go out to eat even though they have a kitchen in their home.”

Shell said that “someday consumers are going to demand that windows be shorter,” but that Universal probably would not be the studio leading the effort.

“The theatrical part of the business is important,” he said, “and so you have to be careful.”

ALSO:

Universal Pictures, with $5.53-billion take, sets global box-office record

Disney CEO Bob Iger aims to bring an NFL team back to professional-football-starved L.A.

DreamWorks Animation sees 43% growth in revenues in third quarter