Workers feel the pain as a post-streaming-wars Hollywood restructures

Contraction. Pullback. Market correction.

However you want to describe what’s going on in the Hollywood economy right now, there’s a potentially brutal long-term consequence of the entertainment industry’s ongoing recession (to call it what it is).

What if a generation of artists, workers and craftspeople decided that a career making film and TV simply wasn’t as viable a path to a middle class lifestyle as it once was?

There have been hints of that kind of sea change in the business over the last few months as production continues to undergo a painfully slow recovery from the writers’ and actors’ strikes and as the media and entertainment companies reckon with the consequences of overspending during the streaming wars.

My colleagues Don Lee and Samantha Masunaga starkly identified the dizzyingly multifaceted set of issues at play in an in-depth piece looking at the state of entertainment employment.

They compared Hollywood to other industries, including manufacturing and agriculture, that underwent their own versions of disruption by technology, changing consumer preferences and globalization. A likely outcome is, they wrote: “a possible return to prosperity and good times for some, ever tighter times for others.”

“There is something of an existential question mark over large swaths of the traditional Hollywood economy,” Stuart Ford, chief executive of Los Angeles-based production company and financier AGC Studios, told The Times.

The numbers are bleak.

Employment in L.A. County’s motion picture and sound recording industries has stayed stubbornly low at about 100,000 through April, down roughly 20% from pre-pandemic levels. That doesn’t account for tens of thousands more people in Southern California who work for Hollywood as freelancers and contractors but aren’t counted in government payroll data.

Aside from the early COVID-19 months of 2020 and last summer’s strikes, employment is at a more than 30-year low, according to the U.S. Bureau of Labor Statistics. It’s not just L.A. that’s seen signs of trouble. Global film and TV production in the first quarter of 2024 lagged 7% behind the same period in 2023, according to ProdPro.

We’ve covered why the studios are feeling the pain right now. The rush to create seemingly infinite content to feed the insatiable streaming beast was unsustainable for traditional media companies, which set up their own direct-to-consumer services and thus cannibalized already precarious box office returns and television networks.

As a result, they’ve cut costs. The annual scripted series count for 2023 was 516, down from 600 during the “Peak TV” year of 2022, according to research by FX Networks. Domestic box office so far this year is a mere three-quarters of what it was in 2023, which, despite the “Barbenheimer” boom, hadn’t even recovered from the COVID-19 pandemic.

Furthermore, generative artificial intelligence technology is poised to become an increasingly disruptive force, with studio chiefs, including Sony Pictures’ Tony Vinciquerra, openly saying the innovations will help them save money by streamlining production. One of the major studios, Paramount, is on the verge of being sold.

All that uncertainty seems to be having a psychological effect on the industry’s leaders and workers, with mounting concerns coming to the fore as Hollywood crew member unions negotiate with studios for better pay and treatment.

On Monday, Teamsters Local 399 and the rest of Hollywood Basic Crafts, which collectively represent 7,600 members including animal trainers, casting directors, drivers, location managers, mechanics, cement masons and plumbers, kicked off their main contract talks with the Alliance of Motion Picture and Television Producers.

In addition to the main issues around compensation, Teamsters are concerned about AI and autonomous vehicles. The International Alliance of Theatrical Stage Employees, or IATSE, the largest union representing Hollywood crew members, remains in its own contract negotiations with the major studios.

“When I first got into this business 22 years ago, you could be a location manager, and your significant other could stay home. It was that good of a job,” location manager Jason McCauley told my colleague Christi Carras. “These days, I can barely pay our bills working 60 hours a week or more.”

According to Teamsters Local 399 chief negotiator Lindsay Dougherty, wage bumps are even more necessary than in past contract talks, “coming off of years of financial distress.”

The Hollywood ecosystem will ultimately come out the other side of this period of financial hardship, albeit changed from what it was and probably smaller in many ways. Companies and industries can reorganize themselves. As we’ve already seen, that’s going to result in significant displacement for workers.

Stuff we wrote

Skydance talks for Paramount near finish line, but Redstone family decision looms. Shari Redstone and her children must decide whether to accept a deal that provides family members with $1.7 billion.

Apple announces deal with OpenAI. Will it be a game-changer? The Cupertino, Calif., tech giant unveiled its long-awaited new artificial intelligence-powered tools, known as “Apple Intelligence,” including a partnership with OpenAI that allows Siri to surface answers from ChatGPT.

Hollywood Teamsters show their pride ahead of contract negotiations. Teamsters Local 399, the union representing animal trainers, drivers, mechanics and other Hollywood crew members, is set to enter negotiations with the studios.

Will Netflix get into the TV news business? Here are the pros and cons. Netflix’s embrace of live sports and commercials makes it look more like traditional broadcast and cable TV. Does adding a news division make sense?

An NFL trial kicks off. How it could affect baseball’s streaming future. Times Columnist Bill Shaikin writes that MLB should be paying close attention to a trial in which the NFL is the primary defendant against allegations that its Sunday Ticket package violates antitrust law.

ICYMI:

- TikTok cyberattack targets CNN, Paris Hilton

- Jeffrey Katzenberg’s WndrCo raises $460 million

- Netflix, Ava DuVernay settle ‘When They See Us’ suit

- DOJ charges Epoch Times CFO in money-laundering scheme

- Warner Bros. Discovery is raising Max prices

Number of the week: $56 million

Sony’s “Bad Boys: Ride or Die,” with its $56-million domestic box office opening, became the latest piece of evidence that a movie can draw a crowd to theaters as long as it has an audience that wants to see it.

This was never really in doubt, despite the fact that the film business has seen some serious trouble lately, largely because of a shortage of compelling content and some real studio misfires (hello, “Furiosa” and “The Fall Guy”). But the strong start for the R-rated buddy cop action comedy with a reported $100-million production budget lends further support to the thesis.

Will Smith is still a movie star, notwithstanding the fallout from his onstage slapping of Chris Rock at the Oscars in 2022. Smith’s chemistry with longtime co-star Martin Lawrence continues to be a winning formula in the Jerry Bruckheimer-produced series. Once again, a movie with popular Black leads outperformed Hollywood’s expectations. Who would’ve thought? As my colleague Greg Braxton argued persuasively, Black and brown audiences could help save the entertainment industry if it lets them.

The fourth “Bad Boys” installment was marketed smartly, with prominent spots airing during the NBA Finals and playing up the summer movie fun. The film generated $48.6 million internationally, for a global kick-off of $105 million. This remains a legit franchise, nearly three decades after the Michael Bay-directed original. “Ride or Die’s” predecessor, “Bad Boys for Life,” debuted with $62 million domestically in January 2020 and ended up with $426.5 million globally on a $90-million production budget.

Walt Disney Co. has a chance to continue the momentum this weekend with “Inside Out 2,” a high-stakes release that could help lift Pixar out of its recent funk. “The Garfield Movie,” another Sony effort, has done good business with $192.7 million worldwide, showing that there’s plenty of demand for animated family movies, but it’ll be in its fourth weekend, so it won’t pose any competitive threat to the Pixar sequel.

Box office optimists should save their popcorn, though. Overall, revenue so far this year is down 26% from 2023, according to Comscore. Consumer appetite for movies in theaters is still strong for the right kind of film, but supply is just not where it needs to be for the industry to be healthy. The second quarter is particularly weak, with Roth MKM analyst Eric Handler predicting a 35% decline from a year ago.

The problem is a lack of depth. Other than the new “Bad Boys,” the only other movie doing significant business over the past weekend was “Garfield,” which has benefited from having almost no direct competition. During the comparable weekend of 2023, there was a new “Transformers” movie, plus a couple of solid holdovers, “Spider-Man: Across the Spider-Verse” and “The Little Mermaid.” More, bigger and better movies means more moviegoing.

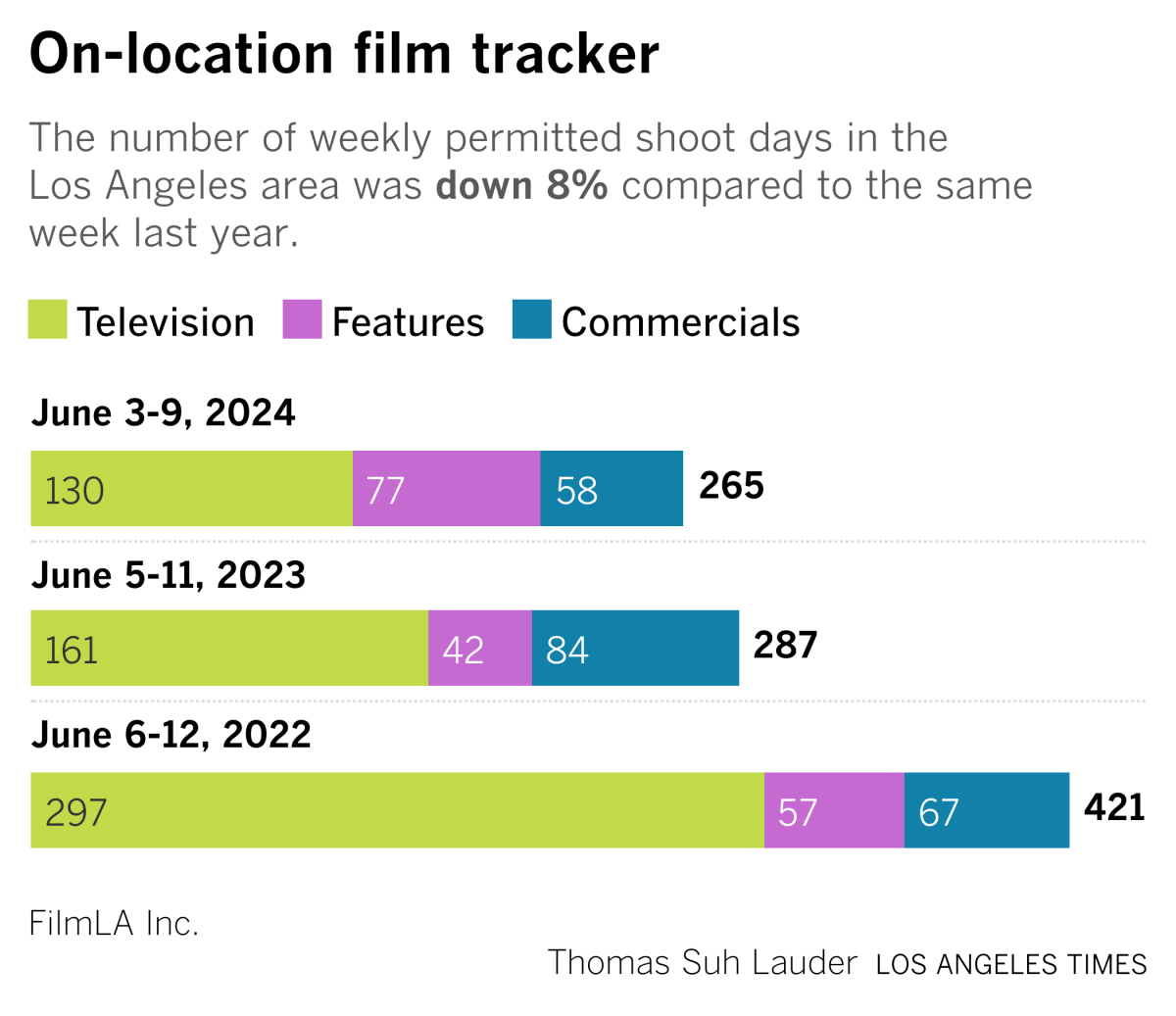

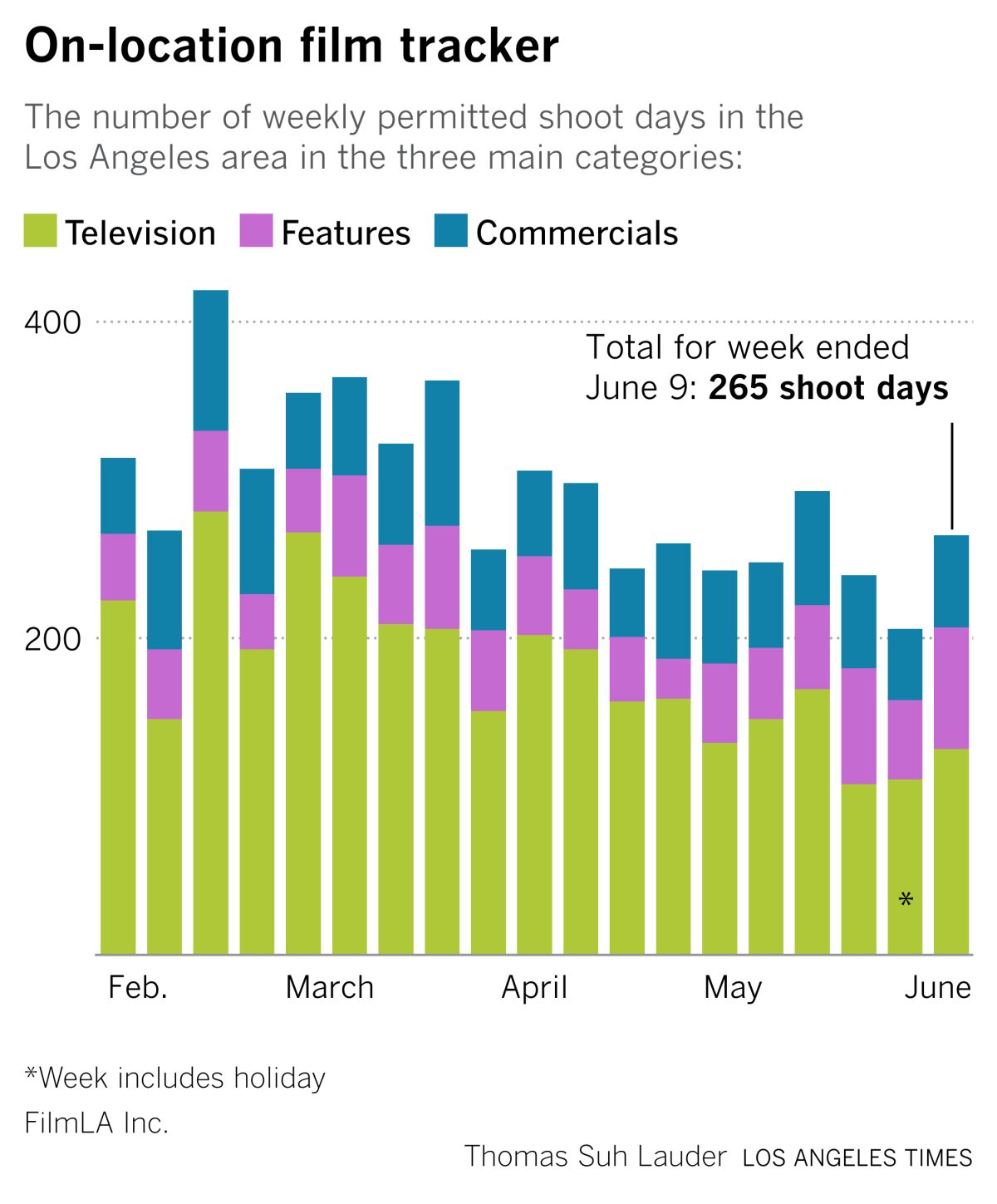

Film shoots

Speaking of weak production numbers, here’s FilmLA’s tally from the last week, compared with previous years.

Finally ...

Who are the people shaping life in Los Angeles? Check out L.A. Influential, The Times’ new, ambitious project studying the various intersecting lanes of power and influence in this dynamic city of ours.

There are plenty of Hollywood figures on the list (including creators such as Ava DuVernay and Eva Longoria, as well as connectors like Bryan Lourd and Fran Drescher) with more to come as we roll it out with additional stories publishing on Sundays. Don’t just look for your own name, Wide Shot readers.

Lastly, Ron Howard speaks to The Times about the life and legacy of Jim Henson.