Disney and Charter end fight. But how long will the cable bundle survive?

- Share via

Welcome to the Wide Shot, a newsletter about the business of entertainment. Sign up here to get it in your inbox.

The traditional cable bundle, which has long provided the underpinning of the television business, survived the dispute between Walt Disney Co. and Charter Communications. On to fight another day.

Charter had threatened that the battle could have resulted in a permanent blackout for ESPN and other Disney-owned channels for the 15 million customer homes that subscribe to its Spectrum service. Instead, the carriage dispute was resolved in time for Aaron Rodgers’ regular-season debut with the New York Jets on ESPN’s “Monday Night Football,” marred by a reportedly season-ending injury for the star quarterback early in the game against the Buffalo Bills.

And so, rather than being put on the fast track to its ultimate demise, the traditional pay-TV package remains in a state of managed decline. Praise be.

“There’s too much inertia in the pay-television ecosystem for it to just go ‘poof,’” Insider Intelligence analyst Paul Verna told The Times. “It’s going to be several more years before people say, ‘OK, we’re done with cable TV.’ It would have been too drastic, too sudden and too soon for cable TV to just go away.”

As my colleague Meg James reported Monday, the sides reached a detente that preserves the bundle for now but also acknowledges that the way that people watch TV is changing fast.

Consumers will continue to gravitate to getting their shows through flexible apps, rather than static channels. In July, linear TV’s share of U.S. television viewing dipped below 50% for the first time as streaming hit a record of nearly 39%, Nielsen said last month. There’s no stopping it.

The shift also is happening among sports fans, the last holdouts from the streaming revolution, who have more options than ever. Streaming giants are including more sports on their apps. YouTube has NFL Sunday Ticket. Amazon’s Prime Video has Thursday Night Football, which is looking to improve its broadcast, per Stephen Battaglio’s recent reporting.

And because of the more than 10-day fight between the Mouse House and the cable guys, a greater number of people now know about the available alternatives.

Amid the blackout, Disney directed angry Spectrum customers to Hulu+ Live TV, its own online replica of a pay-TV offering. In turn, Charter offered folks free trials of Fubo’s streaming television service so that they could catch sporting events unavailable to Spectrum subscribers.

Going into the negotiations, both sides had leverage, though Charter looked like it had the upper hand, according to most observers.

Disney’s channels have popular content, but the company couldn’t afford to lose the $2.2 billion in carriage fees Charter planned to pay it this year, especially amid other disruptions facing the company, including the ongoing strikes by Hollywood writers and actors. TV bundling also has become a less profitable business for Charter, which is focusing more on its broadband internet service, so it theoretically had less to lose.

Nonetheless, the Charter-Disney deal ended with compromises on both sides.

Charter had wanted the ability to offer Disney’s ad-supported streaming apps for free to its broadband customers, a no-go for the Burbank entertainment giant. Disney didn’t cave on that. Rather, Charter will offer Disney’s direct-to-consumer service to its customers — including those who only subscribe to broadband internet — for purchase at “retail rates.”

The upcoming flagship ESPN streaming service will be made available to Spectrum TV Select households when it launches. Charter will include the ad-supported Disney+ app in the Spectrum TV Select video package as part of a wholesale agreement, which will help Disney reach an additional 9.5 million subscriber homes, bolstering its advertising business.

Meanwhile, Charter will “maintain flexibility to offer a range of video packages at varying price points based upon different customer viewing preferences,” the companies said.

Disney gets rate increases, but Spectrum is dropping some of the lesser channels from its service. Sorry to Freeform and Disney Junior, which focus on content categories and audiences that are moving to streaming, as well as FXX, Nat Geo Wild and Nat Geo Mundo.

The arrangement surely will play into future cable dealmaking as media companies including Warner Bros. Discovery and Paramount Global continue to build out their streaming platforms (Max and Paramount+ with Showtime, respectively) while still relying on fees from the cable distributors that are getting undercut by those services.

The analysts at MoffettNathanson, in a Monday note to clients, suggested they anticipate a future landscape of TV packages with fewer channels and more streaming options.

“While perhaps not the end of the Pay TV world as we know it, we very much can look back at this Disney/Charter deal as an opening salvo of a broader re-bundling and a step in giving customers smaller linear bundles with increased [subscription streaming] functionality,” the MoffettNathanson analysts wrote. “If a deal wasn’t reached, Disney was the bigger loser. Given this framework, by almost any means, this agreement is better than most of the alternatives we had considered.”

So call it a draw? In a war like this, it counts as a victory for both companies when the result doesn’t blow everything up.

Stuff we wrote

— The buzziest games this year prove that gamers want old-school couch co-op. Online multiplayer is a gaming staple, but not every big title lets people play together at home. Games like “Baldur’s Gate 3” and “Diablo 4” are reinvigorating the genre.

— Warner Bros. has suspended producer deals. Will it spur a breakthrough in WGA talks or deepen the conflict? Some industry insiders see Warner Bros.’ move as an effort to soften the WGA’s solidarity to spur movement in the talks.

— CAA majority stake sold to Pinault investment firm. Bryan Lourd has been named CEO of the talent representation giant, previously owned by private equity firm TPG.

— Column: As cable TV dies, fans struggle to follow favorite teams, and not just the Dodgers. With sports leagues and teams experimenting with streaming amid an exodus from cable, fans are having problems accessing live sports programming.

— Goodbye, Mr. Gumbel. HBO is ending “Real Sports With Bryant Gumbel” after 29 years. Gumbel has decided to sign off his award-winning program that provided hard-hitting coverage of sports not often seen elsewhere on TV.

— Jimmy Fallon apologizes to ‘Tonight Show’ staff after toxic workplace report. The late-night host spoke up after a Rolling Stone investigation outlined ways in which he allegedly created a toxic workplace.

Number of the week

Strike fatigue is real. Last week’s dueling press releases from the Writers Guild of America and the studios — full of rhetoric, short on news — gave no reason for hope that the sides will return to substantive negotiations anytime soon.

Each side in the strikes is looking for cracks in the other’s resolve. The writers guild’s Friday missive suggested that some studios were willing to break away from the Alliance of Motion Picture and Television Producers and do their own deals to get back to work. In response, the AMPTP member companies sent out a joint statement dismissing that notion. Meanwhile, everyone’s mad at Drew Barrymore.

Studios are feeling the pain of the strikes, which are going on for longer than Warner Bros. Discovery expected when it previously modeled out its profit projections.

The company said in a regulatory filing that its expected profits for the year would probably be $300 million to $500 million lower than it forecast earlier, primarily citing the work stoppages. It’s hard to make money if you don’t release and promote movies and TV shows.

Unsurprisingly, the company has suspended pricy overall deals with showrunners including Greg Berlanti and J.J. Abrams. Other studios are sure to follow, as many have been dealing with buyer’s remorse on those high-profile talent pacts. My colleague Meg James dug into whether that will spur any movement in the contract negotiations.

Cue WGA members online hitting the company for taking a half-billion-dollar hit to its earnings rather than ending the strike by caving to all the guild’s demands.

This comes after the company in its latest earnings call cited the temporary improvement to free cash flow because of production delays due to the strike.

Savings are a priority for heavily indebted Warner Bros. Discovery and its chief executive, David Zaslav, as evidenced by the company changing its executive bonus structure to reward improvements to cash flow.

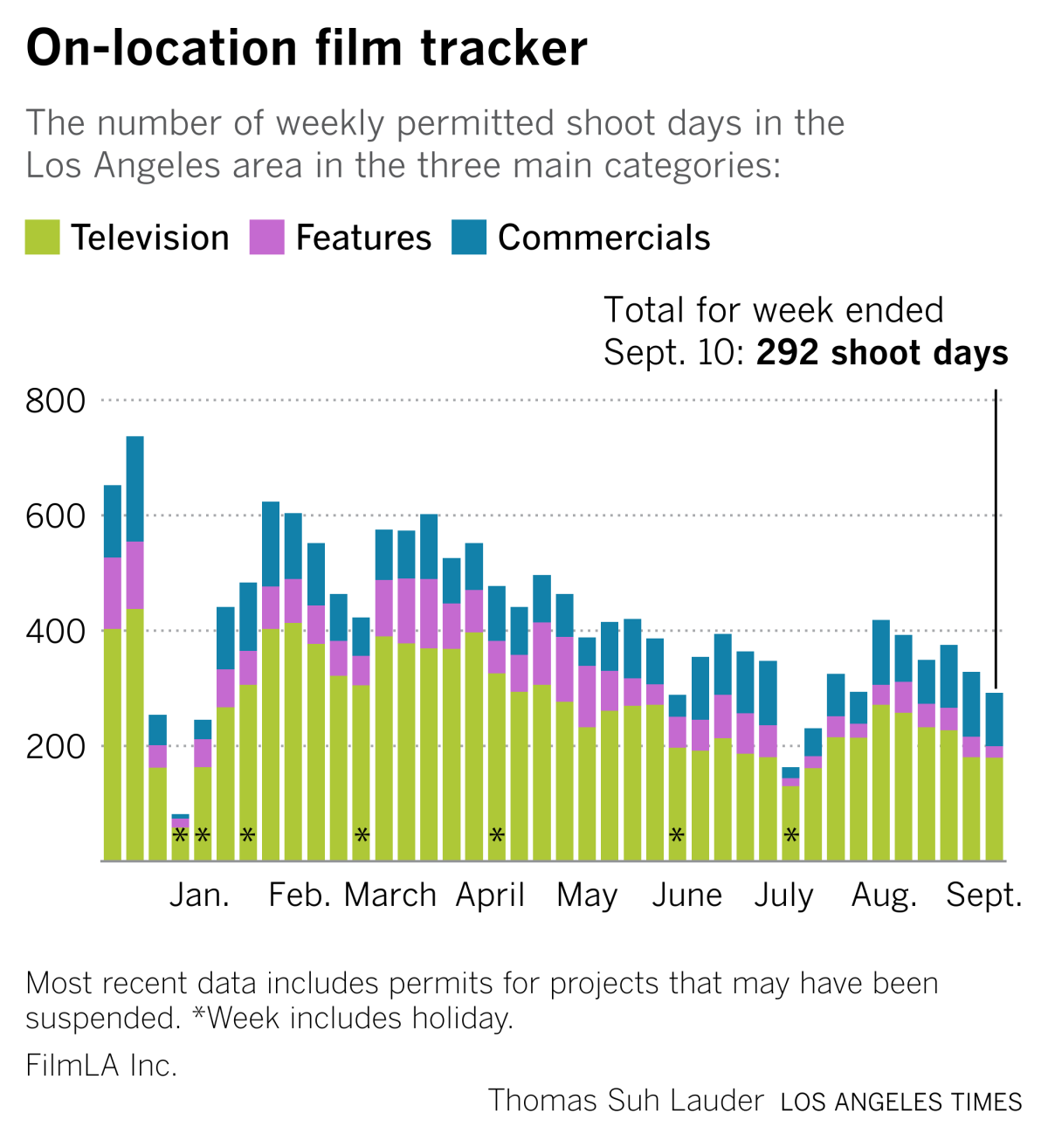

Film shoots

It’s been a couple of weeks since we checked in on production activity in Los Angeles, and it’s not looking good, according to the latest numbers from FilmLA.

Best of the web

— Comcast’s CEO says Hulu is worth more than $30 billion. Disney, which is looking to purchase the cable giant’s remaining 33% stake, presumably has a different take. (Variety)

— Behold, Alex Sherman’s epic story on the failed Disney handoff from Bob Iger to Bob Chapek. (CNBC)

— Say it ain’t so. Vulture calls Rotten Tomatoes the “most overrated metric” in the movie business.

Finally ...

Meet Zulu, an L.A. hardcore band that, according to The Times’ August Brown, “champions Black power and transcendence.” Sounds awesome. And it is.